Risk Analytics — LATAM Auto Insurance

Advanced telematics, pricing and loss-prediction models tailored for Mexican fleets and private auto portfolios.

Overview

Finthrive K2 delivers a modern analytics stack for auto insurers across LATAM: telematics ingestion, exposure mapping, claim severity estimation and pricing optimization with explainable models and local calibration for Mexico (MX).

- Telematics & mobile data ingestion

- Geospatial exposure and fraud scoring

- Explainable ML for underwriters and regulators

Key features

Telematics Scoring

Drive-level risk scores from trip-level telemetry and sensor fusion.

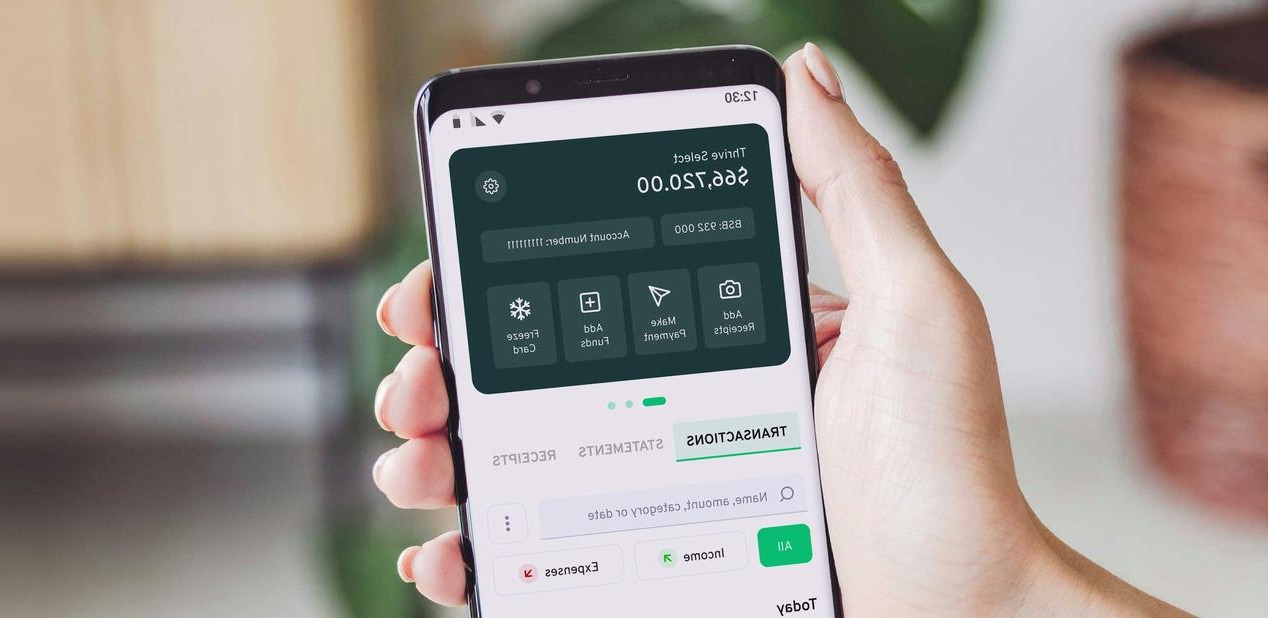

Pricing Engine

Real-time pricing suggestions integrating behavioural and contextual signals.

Claims Severity

Loss prediction models with scenario analysis for reserve planning.

Methodology

We combine domain expertise, local Mexican datasets and open-source tooling to create robust models:

- Data ingestion and governance (privacy-first).

- Feature engineering with geospatial enrichment.

- Modeling with explainability and regulatory readiness.

- Continuous monitoring and recalibration.

Selected case studies

Commercial fleet — Puebla

Reduced claim frequency by 18% after telematics-based driver coaching and targeted underwriting changes.

Personal auto portfolio — Mexico City

Improved pricing segmentation, raising portfolio margin by 6% while maintaining retention.

Performance snapshot

| Model | Metric | Baseline | Finthrive K2 |

|---|---|---|---|

| Claim Frequency | AUC | 0.68 | 0.79 |

| Severity Estimate | RMSE | 1.24 | 0.87 |

| Pricing Uplift | Portfolio Margin | — | +6% |

FAQ

Our team in LATAM

Local data scientists, underwriters and product managers in Mexico and Colombia collaborate to tailor models for regional idiosyncrasies.

- Local calibration & regulatory guidance

- 24/7 regional support

- Deployment and MLOps assistance

Resources & integrations

Integrations

APIs for policy systems, telematics vendors, and claims platforms. On-premise or private-cloud options available for sensitive workflows.

Integration checklistWhitepapers

Downloadable studies on telematics adoption in Mexico, loss prediction improvements and pricing segmentation best practices.

Access resourcesModel registry (sample)

| Name | Type | Last updated | Notes |

|---|---|---|---|

| freq-k2-v3 | Classification | 2025-03-12 | Calibrated for MX urban fleets |

| sev-k2-v2 | Regression | 2025-02-07 | Severity with external parts-cost index |

Ready to modernize underwriting?

Contact our LATAM analytics team to schedule a demo or pilot tailored to your portfolio.

Schedule demo Data & privacy